Bayelsa Assembly approves N17bn loan for Diri

Nathan Tamarapreye

The Bayelsa House of Assembly has approved an additional N17bn loan from multiple sources for Gov Duoye Diri to fund his administration’s policies and programmes for the people.

On March 3, 2020 two weeks after inauguration, Diri secured approval to borrow N2.9bn from commercial banks to buy cars for himself and top government officials.

The latest approval was given by members of the state House of Assembly on Thursday at its plenary upon their return from long vacation.

The approval followed a motion moved by the leader of the House, Hon Monday Obolo, Southern Ijaw Constituency 2 and seconded by Hon Charles Daniel, Brass Constituency I, occasioned with intensive debates in support for the approval.

Diri in three separate letters dated October 26 and November 9, 2020 addressed to the Speaker of the House, read at the plenary by the Clerk of the House, Mr Edward K Owudogu, had solicited the lawmakers to approve his requests.

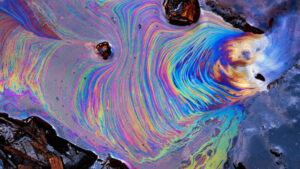

In the requests, the governor sought the House approval to access a N4bn Sustainable Development Goals (SDGs) Counterpart Fund and a N10 bn facility from the Central Bank of Nigeria (CBN) to develop oil palm potentials.

In another letter, the governor also urged the House to approve N3 billion, as a revolving temporary credit facility, with a 12 Months tenor, to fund state financing gap when there is a shortfall in monthly revenue accruing to the state.

“As part of this administration’s efforts to cushion the effect of the global economic downturn occasioned by the COVID-19 Pandemic and the dwindling oil revenues, we seek to take advantage of intervention funds from the Federal Government through the Central Bank of Nigeria and Sustainable Development Goals (SDGs) programme.

“The facility from the Central Bank of Nigeria will aid the state government to develop our oil palm potentials, while the Sustainable Development Goals (SDGs) Counterpart Fund is a prerequisite for the state to attract a matching grant under the SDGs.” Dirk’s letter read in part.

He stated that the N4bn Sustainable Development Goals (SDGs) Counterpart Fund would be obtained from a Commercial Bank.

According to the letter, the N10bn facility from the CBN when acquired would be used to finance the development and expansion of existing oil palm potentials in the state.

In the letter for the N3 bn Diri said: “ Due to the global economic downturn and dwindling revenue, it has become imperative to source for a revolving short-term Credit finance line to fund gaps when there is a short fall in monthly revenue accruing to the state.

“This credit line will enable the state government to respond appropriately to critical monthly financial obligations. The standing instruction will eliminate reoccurring documentation costs.

“The facility shall be for tenure of Twelve Months as Temporary Overdraft with short-term Clean up Circle.”

Checks at the official website of the Debt Management Office indicated that the debt profile of the state as at June 30, 2020 stood at N150.05bn while as at March 31, 2020 few weeks from Feb 14, 2020 the debt stock was N154.95, indicating a marginal decline.

The House also approved Governor’s request for the appointment of additional 10 Special Advisers in line with the provision of section 196 of the 1999 Constitution of the Federal Republic of Nigeria as amended.

Post Comment